Max out roth ira calculator

But if you want to know the exact formula. You may also want to check out the Marketing ROI calculator on the site as well.

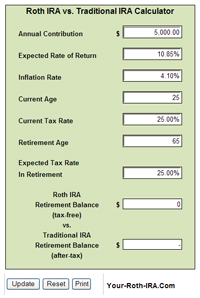

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Find out the ones that work best for you.

. How to Calculate Real Estate ROI. And can I contribute to a Roth IRA even though I max out my Roth 401k. Anything after that should be in a brokerage account or real estate.

If you have a 401k or other retirement plan at work. Roth IRA withdrawal rules allow you to take out up to 10000 earnings tax and penalty free as long as you use them for a first-time home purchase and you first contributed to a Roth account at. If your Modified Adjusted Gross Income is too high you may be ineligible or only eligible to make a partial contribution to a Roth IRA.

The max for a Roth IRA remains unchanged from 2021 at 6000 7000 for those age 50. Lets be honest - sometimes the best real estate roi calculator is the one that is easy to use and doesnt require us to even know what the real estate roi formula is in the first place. Use those numbers in our calculator to find out your VO2 max.

And if you have a Roth 401k at work great. Money that youll need before retirement should not be in a 401k or IRA. Right now I contribute the maximum to my Roth each year.

Social Security benefits calculator. For 2022 the Roth IRA contribution limit is remains as it was in 2021. A different limitation may apply to Roth contributions.

401k required minimum distributions start at age 70 12 or 72. 22 min read Sep 01 2022. If you dont get an employer match if you plan to max out your 401k or if your 401k has narrow investment options or high fees it might be a good idea to invest primarily in an IRA.

Le livre numérique en anglais. If you havent reached 15 at that point go back and invest in your 401k. Roth IRA could make sense according to Brewer.

Finally make an irrevocable transfer of the after-tax funds into a Roth IRAthe sooner the better since any earnings will become taxable once rolled over. However there are some exceptions. And if youre 50 or older you can contribute up to 1000 more making the over-50 contribution limit 7000.

A Roth IRA is a retirement account that lets your investments grow tax-free. However contributions to a Roth IRA arent tax deductible. There are two types of IRAs.

Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate. To which type of IRA plan and how much can be contributed or can be treated as tax deductible is influenced by many factors. For example if youre 45 and youve contributed 4000 to a traditional IRA only 1500 is available to contribute to a Roth.

Dont panic and take all your money out of the investments in your Roth IRA. However depending on your household income your Roth IRA contribution may be limited or even eliminated. Wed suggest using that as your primary retirement account.

For 2022 the annual contribution limit for both is 6000 with a 1000 catch-up if youre age 50-plus. A person can make an annual contribution to a Traditional or Roth IRA at any age as long as they have earned income. You must designate the account as a Roth IRA when you start the account.

Use this calculator to determine the max you can invest. You can contribute up to 20500 in 2022 with an additional 6500 as a catch-up. Our VO2 max calculator will give you a very good estimate of your VO2 max using the VO2 Max formula above.

Next contribute after-tax dollars up to the overall limit of 61000 in 2022 67500 if age 50 or older. To use the calculator first you must walk one mile as fast as you can. When saving for retirement get the employer match then max out your Roth then go back to max out your 401k.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. Theres No Such Thing as the Best Investment for Everyone. If you are looking to max out your Roth IRA in 2022 your income must be below 129000.

Upon completion immediately measure your heart rate and record your completion time in seconds. I plan to roll the Roth 401k into a Roth IRA before 72 to avoid having to take an RMD. This limit applies across all IRAs.

Find the best CD rates by comparing national and local rates. Understand how to calculate when you have to take RMD withdrawals from your 401k. To which type of IRA plan and how much can be contributed or can be treated as tax deductible is influenced by many factors.

This means you should invest in your 401k up to your match hey its free money then max out your Roth IRA. First max out your normal 401k contributions. But there are other times that a traditional vs.

6000 which is the same amount as the traditional IRA limit. A Roth 401k and a Roth IRA sound similar and they are. Use this calculator to determine the max you can invest.

Roth IRAs are subject to the same rules as traditional IRAs. A traditional tax-deductible IRA and a Roth IRA. Roth IRA contributions are still a long-term investment in a retirement savings plan.

However each IRA does have an income ceiling that will. A traditional IRA is your only option if you dont qualify for a Roth IRA due to income restrictions. In the event that you.

A person can make an annual contribution to a Traditional or Roth IRA at any age as long as they have earned income. In 2021 the annual contribution limit for Roth 401ks was 19500 26000 for those age 50. Contributions are made after taxes meaning your taxable income isnt reduced by the amount of your contributions when you file.

Ebook ou e-book aussi connu sous les noms de livre électronique et de livrel est un livre édité et diffusé en version numérique disponible sous la forme de fichiers qui peuvent être téléchargés et stockés pour être lus sur un écran 1 2 ordinateur personnel téléphone portable liseuse tablette tactile sur une plage braille un. Retirement Calculator Investment Calculator Net Worth Calculator. Do I need to open a Roth IRA five years prior to the rollover to meet the 5-year rule.

Married couples filing jointly must have a modified AGI of less than 204000 to contribute the max to a Roth IRA.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Ira Calculator Roth Deals 52 Off Ilikepinga Com

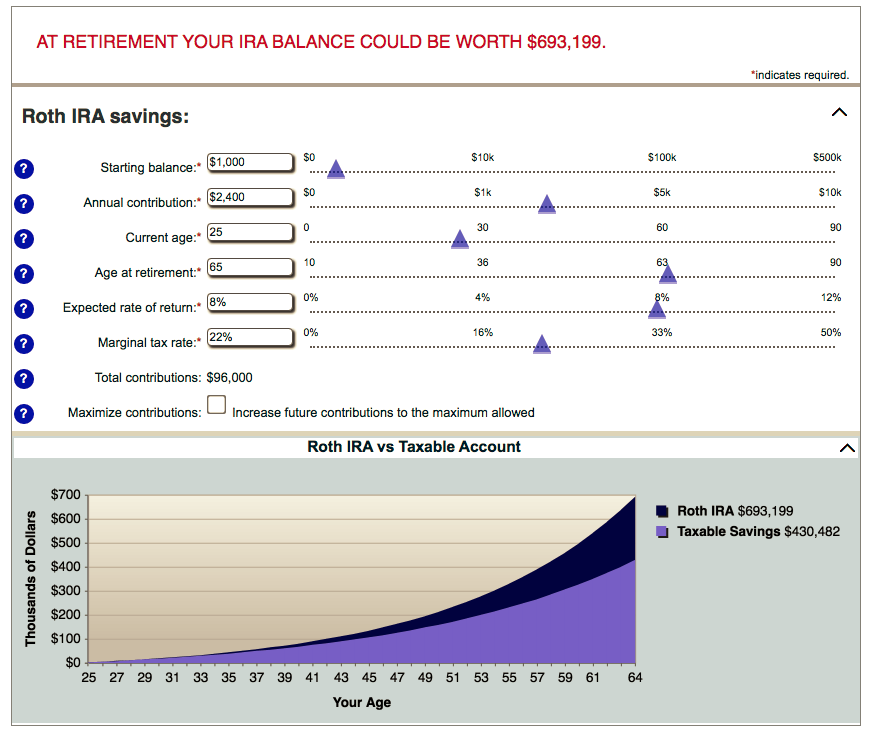

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

How To Use A Roth Ira Calculator Ready To Roth

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Download Roth Ira Calculator Excel Template Exceldatapro

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Roth Ira Contribution

Ira Calculator See What You Ll Have Saved Dqydj

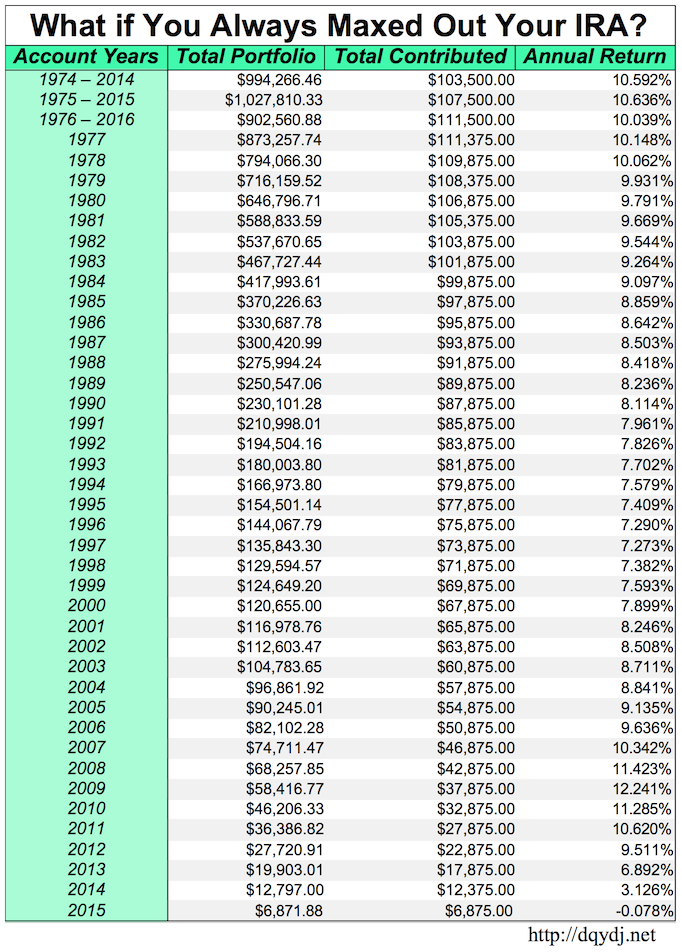

What If You Always Maxed Out Your Ira Seeking Alpha

Historical Roth Ira Contribution Limits Since The Beginning

Is It Worth Doing A Backdoor Roth Ira Pros And Cons